Jason Mandel is the author of the best-selling book Demand Transparency: Stop Wall Street Greed and Rising Taxes From Destroying Your Wealth. We sat down with him for an exclusive interview to learn more about his years of experience working with ultra-high-net-worth families and other high-earning professionals, helping them mitigate taxes and create generational wealth through proven and tax-compliant programs.

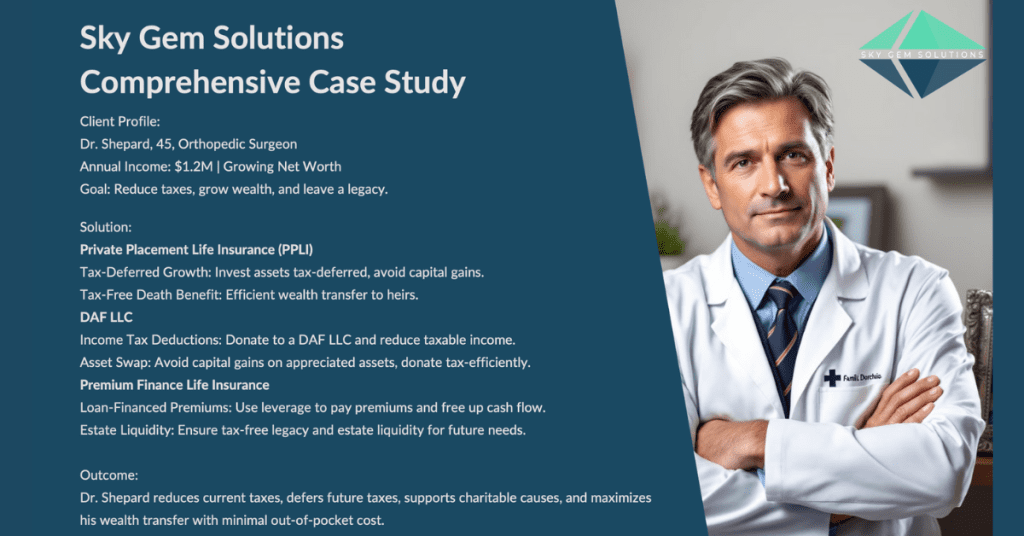

His holistic asset and risk management advisory firm, Sky Gem Solutions, is laser-focused on providing their clients with innovative, bespoke financial solutions focused on wealth creation, wealth preservation and tax efficiency. The firm’s process is not product- or sales-focused; instead, Jason and his team gain a deeper understanding of each unique client’s current situation and what their future priorities are.

The epicenter of that analysis is investment management, tax planning, estate planning, philanthropy, and wealth transfer. Jason has worked with many medical professionals and understands the specific importance of asset protection in combating unscrupulous litigation.

“We focus on structures that create a bulletproof tax fortress around wealth. We advise people on how to protect themselves in a proven structure for the legitimate concern for asset protection from unfair litigation. We help doctors arrange their wealth inside litigation-proof structures,” Jason Mandel stated.

Mandel’s Background

His vision was fueled by an experience he had when he was 14 years old, working in a local bagel shop. He met and served a frequent, loyal customer who was always smiling brightly and excited about life. Mandel asked him what made him so happy every morning. The man replied, “I built my own company that enables people to create tax-free income for themselves and helps them protect their families.” His interaction with that businessman inspired Mandel to assist others to take control of their finances and protect their wealth from losses due to market weakness and taxation. When the customer in the bagel shop returned a week later, Mandel asked him if he could work for him, affording Jason the opportunity to absorb and learn from his potential new mentor. Jason got the job.

That job began the journey of Mandel’s pursuit in life- to help others achieve tax minimization and wealth security. Mandel worked for the man he met in the bagel shop throughout junior high and high school. Mandel saw firsthand how doctors and other successful individuals earned significant amounts of money but, somehow, were receiving ineffective counsel from their advisors and needed assistance to take control of their wealth management decisions.

“By the time I was 18, I knew I had a passion for this business. When I went to Brandeis University, my plan and goal was to become a trusts and estates attorney. I was going to make a positive impact helping people by producing their legal structures and working with them to identify appropriate investment solutions. But I graduated college a year early and had a year before starting law school, so in 1995, I landed my first job on Wall Street at Cantor Fitzgerald in the World Trade Center. That is when I fell in love with Wall Street!” he explained. So, instead of going to law school, Jason went and earned a Master of Science from Columbia University.

The Road to the Mandel Family Office and SkyGem Solutions

“The tax elimination business has fascinated me for some time. When I left Cantor Fitzgerald, I joined D.E. Shaw, one of the largest hedge funds in the world, where I learned about alternative investment strategies. In 1999, I created my own firm, went out on my own and never looked back,” Mandel said.

Doctors often have the money needed to structure wealth but lack proper advice. Their money managers, if they even have them, often make ill-advised decisions and misdirect doctors into transactions that are not ideal on a risk-adjusted basis.

“We believe you can achieve returns without a high correlation to the stock market. There are products that give you the upside of the market with little to no downside. There are products that give you consistent returns without the wild swings and volatility. If you made 10% a year consistently without a lot of risk, that’s better than making 10% with massive swings where one year you’re up 21%, then you’re down 11%, you’re up 40%, and then the next year you’re down 50%. Nobody wants the volatility. We employ lower volatility solutions to achieve a more efficient return and consistently generate returns. We do that through a combination of strategies,” Jason Mandel shared.

His unique setup is 4-legged:

- Create legal structures that are bulletproof tax fortresses.

- Utilize a group of CPAs and tax attorneys to create opportunities from strategies directly in the tax code and not dangerous tax shelters that come and go.

- Employ risk management analysis that probes into all avenues to achieve tax elimination and asset protection.

- Identify investment solutions that are not dependent on the stock market going up, like asset-backed lending and arbitrage managers.

“We are like the quarterback of our client’s financial team. The Mandel Family Office and Sky Gem Solutions help clients manage their various advisors to ensure they work towards a common goal. We substitute our own recommended advisors when a player is incompetent or underperforming. We manage the lawyer, accountant, insurance broker, and asset manager. If we don’t coordinate together, we can’t achieve maximum results. Our goal is to help doctors achieve their goals in life,” Mandel said.

This intense and focused approach does not afford Mandel the time to spread his expertise beyond a very small subset of the wealthiest families. That is why he created and built a team called Sky Gem Solutions. “My team at Sky Gem takes all of my best practices and solutions and delivers them to a greater audience of people I would never have the opportunity to meet myself.” Mandel continued, “High earners and wealthy families have as much if not more need for these solutions than the ultra-wealthy clients I work with, and now they can!”

Recently, Mandel published a book, Demand Transparency: Stop Wall Street Greed and Rising Taxes from Destroying Your Wealth, which hit number one on Amazon in several categories. The book is all about taxation, portfolio management, and insurance, based on the Mandel team’s ideas and success in this field. “Most doctors I talk to may have a 401(k). This is normally correlated to the stock market. Sometimes, we tell our clients to get rid of their taxable accounts. We call it our 401(k)-rescue plan, where we actually seek to eliminate all taxation from their investments. We then help them mitigate the taxes that might be created from selling off their 401(k). From there, we can put them into a tax-free retirement plan,” he said.

In many cases, Mandel can wrap the client’s assets into a structure that grows completely tax-free, and funds can be accessed anytime without any penalties or taxation. “Doctors historically haven’t taken the time to ensure the most critical part of asset management is done right. Medical professionals put in long, stressful hours, so their time is limited. My involvement in helping doctors gives me tremendous satisfaction and pride because we’ve eliminated taxation for most of the doctors we work with on a vast majority of their capital gains.”

“Let me give you a real-life example. A doctor from California was paying approximately 50% of his income in taxes annually. He had health challenges and, at 45 years old, was losing hope he could retire comfortably in ten years’ time. After understanding all his issues, desires, and concerns, we went to work.

We created a Donor Advised Fund (DAF) LLC, which helped him reduce 60% of taxable income through an innovative structure similar to the one Mark Zuckerberg created in 2015, and it is still utilized to be in control of his investments and philanthropy.

We also created a financed tax-free income plan, which offered this physician the upside of the stock market indices without any downside participation. He is resting easy and less worried about how he can now afford to transition his practice and enjoy his retirement. After some time working with us, we are now exploring transitioning his wealth into a private placement life insurance policy to eliminate all capital gains taxation on his portfolio for the rest of his life!

Additionally, his assets are now protected against any litigation or unfair creditors coming after the nest egg he worked so hard to build, and so many doctors lose. This nest egg can be left to his heirs without worrying about estate taxes from the federal government and the state of California. This has allowed the doctors to take care of their families and give their patients the best care.”

“Working with companies such as ours grants doctors the opportunity to manage their wealth better and improve their lives and stress levels.” Jason and his team even have solutions to improve practice efficiency and profitability. Employee retention is something most medical professionals worry about. Sky Gem has a program that is a retention tool and benefit to the employees while simultaneously creating an additional platform for wealth creation for that doctor.

“Imagine being able to tell your employees that you have added a benefit to them in the form of life insurance and catastrophic accident or illness insurance. You can say to those employees, while you are employed and at no cost to you, you will be in a program to protect your family from the threat of you becoming severely ill, injured, or passing away,” said Mandel.

The doctors receive the largest benefits, including a potential tax deduction, a war chest of cash value to access in time of need, tax-free income in retirement, ownership of the policies, and a strong retention tool, typically not offered in the industry.

Mandel continued, “This is a strategy that 68% of Fortune 1000 companies employ for their benefit. Some do it for Key Person Insurance, and some for funding buy-sell agreements to fund other benefits plans, but many use this to build a tax-advantaged asset they can use for the benefit of the business or themselves when they decide to! These are not qualified plans, so there is great flexibility in how a doctor could set up a plan.”

Jason Madel and his company have helped countless wealthy families and doctors eliminate or mitigate their tax burdens and create and preserve generational wealth. These strategies have been employed and validated over the twenty-five-plus years of solely focusing on this task. Mandel believes doctors deserve to learn how to do the same for themselves, their families, and employees.

For more information on the solutions mentioned in this article, please scan the QR code or go to https://topdoc.skygemsolutions.com/.

0 Comments